April 21, 2024 – SELVA DEMIRALP

Previously published on VoxEU on April 18, 2024

Amid a global surge in populism, political pressures on central banks to lower interest rates have escalated, driven by populist politicians’ preferences for low rates to fuel short-term, growth-oriented policies. This column explores the impact of this heightened political pressure on financial market and central bank behaviour. It finds that political pressure for low interest rates can backfire by destabilising financial markets, leading to undue volatility in exchange rates and the potential disruption of inflation expectations.

In a world increasingly influenced by the surge of populism (Acemoglu et al. 2013, Rodrik 2017, Funke et al. 2020), political pressures on central banks to lower interest rates have escalated. This phenomenon is rooted in politicians’ preferences for lower interest rates to fuel short-term, growth-oriented policies. Despite these pressures, central bank independence has also been strengthening (Romelli 2024), enabling these institutions to maintain a focus on long-term price stability and sustainable growth.

In a recent paper (Çakmaklı et al. 2023), my co-authors and I explore the consequences of heightened political pressures from populist leaders on the financial market and central bank behaviour. Our study underscores how institutional robustness and the autonomy of central banks serve as bulwarks against political influences, safeguarding financial stability.

When comparing the central banks of Türkiye and the US, both of which have faced similar levels of political pressure to reduce interest rates, we find that it is the Turkish central bank that is straying from its hawkish stance. Financial markets rationally price in this anticipated response from the Turkish central bank, while largely disregarding political pressures in the US. Our findings underscore the irony that political demands for lower interest rates push market interest rates in the opposite direction, increasing risks and inflationary expectations, and thereby impairing the monetary transmission mechanism. Demands for lower interest rates end up tightening financial markets and hampering growth – the opposite of what the politicians were aiming for.

The crucial takeaway from our findings is that political pressures towards low interest rates can destabilise financial markets, leading to undue volatility in exchange rates and the potential disruption of inflation expectations. To maintain financial stability, communication between the central bank and the government should ideally occur behind closed doors, especially in emerging markets, where central bank credibility is more vulnerable. Such discretion is crucial to prevent financial market turbulence and the subsequent impact on the real economy through spillovers onto asset prices.

Our analysis has implications for the recent developments in the Turkish financial markets as well. Although not covered in our sample period, the independence of the Turkish central bank further deteriorated further after 2019. The central bank governor was replaced six times over the six years leading up to 2024. Ironically, as the central bank’s independence weakened, public criticism of the central bank significantly declined. Following the May 2023 elections, the central bank adopted a hawkish stance, raising interest rates by 40 percentage points in eight months. However, despite such a hawkish stance, the evident hesitation of international investors to enter Turkish markets can be interpreted as the long-lasting impact of persistent political pressure over the course of monetary policy.

The economic impact of political pressures

Historically, central banks in emerging markets have been vulnerable to political pressures due to weaker institutional frameworks. Conversely the Federal Reserve, known for its staunch institutional independence (Cukierman et al. 1992), was put in an unusual position when faced with severe criticism from then-US President Donald Trump, who wanted interest rates cut. Such political pressures can divert central banks from their optimal policy trajectory, prompting financial markets to adjust their pricing in anticipation of the potential effects on central bank actions. However, discerning whether a central bank has succumbed to these pressures is not always straightforward. This is particularly the case when the central bank’s actions align with the political leader’s ‘suggestions’.

For illustration, consider a scenario where someone habitually takes a painkiller for a headache. If they are advised to take a painkiller after experiencing a headache, it is ambiguous whether they followed the advice or acted independently. This ambiguity parallels the situation where criticism by politicians of central banks for not lowering interest rates is followed by subsequent rate cuts. The initiation of the Fed’s easing cycle in July 2019, amid public critiques by President Trump, is one such example that sparked debates about the Fed’s independence.

Determining whether the Fed acted independently or under political duress is crucial. Independent action means the markets would not expect a deviation from the optimal policy course, keeping inflation expectations stable. Conversely, uncertainty about the Fed’s motivations could lead to increased market volatility or unanchored inflation expectations.

Understanding political pressures and their implications

To shed light on the impact of political pressures, we evaluate how financial markets and central banks react to such dynamics. We quantify political pressures by scanning Bloomberg archives for commentaries in which political leaders advocate lower interest rates, identifying statements from leaders across 66 countries between 2015 and 2020.

If a particular leader made at least five political commentaries advocating for lower interest rates, we included the country and leader pair in our sample to assess the impact of these political commentaries (PCs) on financial market dynamics and central bank behaviour. Our final analysis focuses on six countries: Brazil, Colombia, Hungary, New Zealand, Türkiye, and the US.

Here are some examples of the political pressures that we identify:

- “I still find the current interest rate high. This interest rate must fall.” (Erdogan, Türkiye, 16 September 2012).

- “The central bank may ’cause harm’ by not following the government’s economic policy.” (Orban, Hungary, 22 December 2010).

- “I personally think the Fed should drop rates. I think they really slowed us down. There’s no inflation. I would say in terms of quantitative tightening, it should actually now be quantitative easing.” (Trump, US, 5 April 2019).

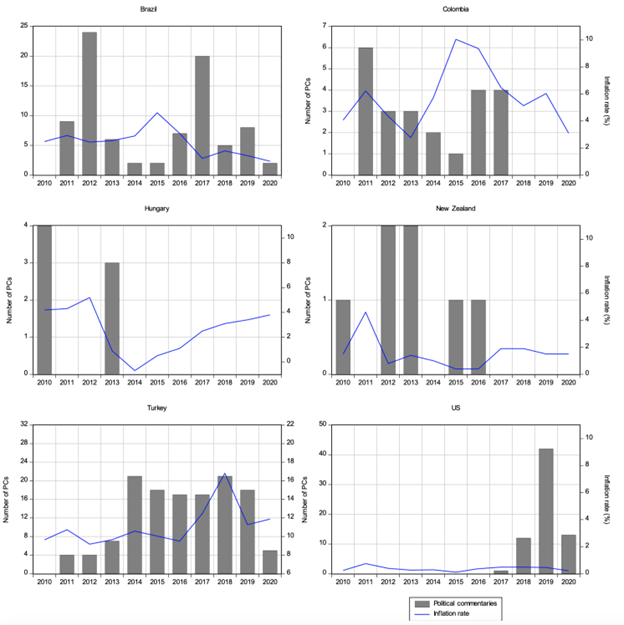

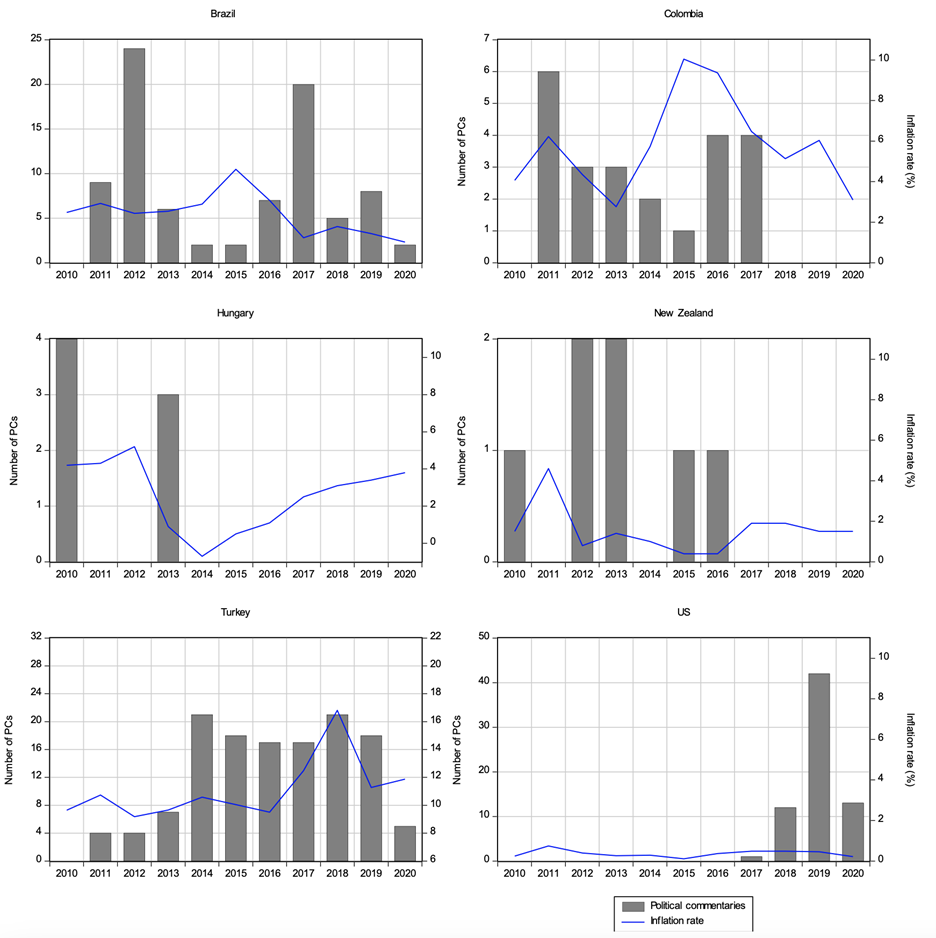

A quick way to assess whether central banks have withstood political pressures is to plot the long-term inflation performance in their respective countries together with the political commentaries. Stable inflation rates are indicative of central bank independence and credibility. Figure 1 displays the relationship between political commentaries (grey bars) and inflation rates (blue lines) for each country in our study. The political commentaries are aggregated annually, and for 2020, we present the cumulative data up to August, the last month covered in our analysis.

The graph reveals a link between escalating political pressures and increasing inflation rates in Türkiye. Brazil ranks second, with unsatisfactory inflation outcomes and significant political pressures up to 2018. In contrast, the other countries demonstrate superior inflation control, suggesting the presence of independent and credible central banks. Notably, despite President Trump’s frequent criticisms of the Federal Reserve, the inflation rate in the US consistently met or remained below target throughout the period of our study.

Conclusions and findings

We discover that political pressures for more accommodative policies significantly influence market pricing and central bank behaviour. The severity of these pressures, the institutional strength of the country, and the global GDP share of the political leader’s country are critical factors in determining the extent and repercussions of this impact. As political pressures mount, the response of the financial market intensifies. To analyse this dynamic impact, we employ a Bayesian estimation strategy, which allows us to consider the uncertainty in parameters and unobserved components simultaneously.

Türkiye exemplifies a country experiencing substantial political pressure. The Turkish lira depreciates and long-term bond rates, along with the risk premium, increase in response to domestic political pressures. These market reactions reflect the expectation that the central bank will succumb to such pressures. Specifically, President Erdogan’s calls for lower interest rates led to an average depreciation of about 20 basis points in the daily percentage of the nominal return of the lira against the dollar. This impact has shown an upward trend over time, reaching approximately 30 basis points (or 0.3 percentage points) by the end of our sample.

We also observe a significant response in 10-year Turkish bond rates and the credit default swap premium after 2013. Political commentaries perceived as direct interference with monetary policy adversely affected the broader financial markets and the Turkish economy by increasing bond prices and the risk premium.

In other countries with less intense political pressures, domestic political influences do not seem to affect market pricing. Nevertheless, President Trump’s comments temporarily impacted exchange rate returns in these countries. While Trump’s intense pressure on the Fed did not influence market sentiment in the US, where institutional strength is well-established, his persistent remarks were viewed as potential interference with the Fed’s actions in countries with weaker central bank independence, leading to increased exchange rate volatility. One implication of these findings is that political pressures have a more significant impact in countries with weaker institutions because perceptions about the local central bank introduce a bias in forming expectations about other central banks’ responses to political pressure.

To conclude our analysis, we estimate the reaction functions of central banks to determine whether market pricing of political commentaries aligns with central bank behaviour. We find that markets are mostly rational. In countries where the central bank does not succumb to political pressures, markets generally ignore political commentaries as well. However, if the central bank accommodates political pressures, markets incorporate this response into their pricing, as observed in the cases of Türkiye and Brazil. Specifically, political commentaries advocating for rate cuts are associated with a reduced likelihood of monetary tightening. Despite the intense political pressure exerted by President Trump, his political commentaries did not significantly influence the decisions of the Federal Reserve. These Taylor rule estimates for the US, Türkiye, and Brazil are consistent with previous research findings (see Demiralp et al. 2019 for the US, Demiralp and Demiralp 2019 for Turkey, Asfuroğlu and Güneş 2023 for Brazil).

References

Acemoglu, D, G Egorov and K Sonin (2013), “A political theory of populism”, The Quarterly Journal of Economics 128(2): 771–805.

Asfuroğlu, D and G S Günes ̧(2023), “Do political commentaries command? The case of Central Bank of Brazil”, Brazilian Journal of Political Economy 43(3): 686–705.

Çakmaklı, C, S Demiralp and G Günes (2023), “Do financial markets respond to populist rhetoric?“, Oxford Bulletin of Economics and Statistics.

Cukierman, A, S B Webb and B Neyapti (1992), “Measuring the Independence of Central Banks and its Effects on Policy Outcomes”, World Bank Economic Review 6: 353–98.

Demiralp, S and S Demiralp (2019), “Erosion of Central Bank independence in Turkey”, Turkish Studies 20(1): 49–68.

Demiralp, S, C Scotti and S King (2019), “Does anyone listen when politicians talk? The effect of political commentaries on policy rate decisions and expectations”, Journal of International Money and Finance 95: 95–111.

Funke, M, M Schularick and C Trebesch (Forthcoming), “Populist leaders and the economy”, American Economic Review.

Rodrik, D (2018), “Populism and the economics of globalization”, Journal of International Business Policy 1: 12–33.

Romelli, D (2024), “Recent trends in central bank independence”, VoxEU.org, 26 Feb.

Photo by Elif Nur

0 Comments